estate and gift tax exemption sunset

As of 2021 the federal estate and lifetime gift tax exemption is 11700000 per individual 23400000 for a married couple. Though all property is assessed not all of it is taxable.

What Will Happen When The Gift And Estate Tax Exemption Gets Cut In Half Duckett Law Office

Others are partially exempt such as veterans who qualify for an exemption on part of their homes and homeowners who are eligible.

:max_bytes(150000):strip_icc()/There-Are-Disadvantages-To-Using-Trust-Funds-57073c733df78c7d9e9f6f05.jpg)

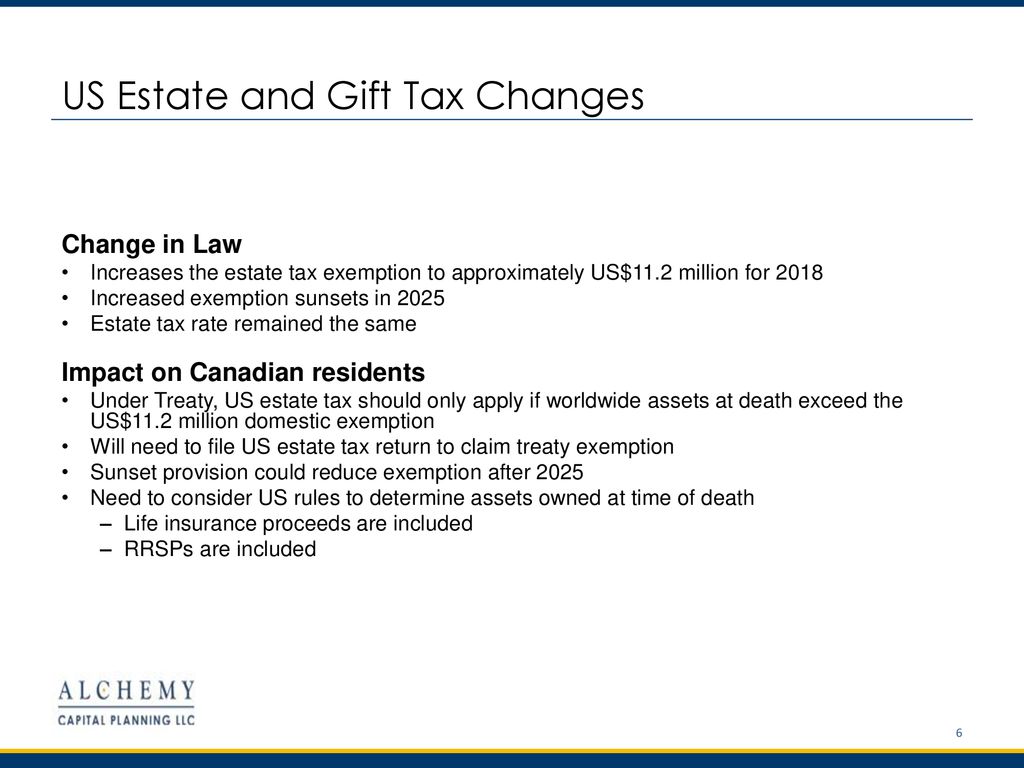

. The current estate tax and gift tax exemption indexed for inflation is 1206 million per person under the prior law the exemption would be roughly one-half of that amount. 24 Upon the death of a taxpayer the estate tax is imposed at a rate of 40 on any portion of his or her gross estate that exceeds 1206 million but this exemption amount can. The TCJA temporarily increased the federal gift and estate tax exemption from 5 million to 10 million with both amounts adjusted for inflation beginning in 2018.

This means that to use up your extra estate exemption before it sunsets you could consider making gifts either directly to heirs to an irrevocable trust or to a 529 plan. The current exemption will sunset on Dec. Portability of the estate tax exemption between spouses is in effect so when Sue dies.

Maybe not tomorrow but the sunset of our historically high estate tax exemptions is comingand with the election on its way it could be sooner than you think. What happens to estate tax exemption in 2026. The increase is scheduled to sunset at the end of 2025 which means that starting in 2026 the exemption is set to return to the prior amounts unless the law is again updated.

Projections for the post-sunset. In general the Gift Tax and Estate Tax provisions apply a unified rate schedule to a persons cumulative taxable gifts and taxable estate to arrive at a net tentative tax. New Power of Attorney Law Bullet Points.

Fast-forward to 2026 and the estate and gift tax exemption amounts will sunset unless otherwise extended by Congress and the president. As of 2021 the federal estate and lifetime gift tax exemption is 11700000 per individual 23400000 for a married couple. This means that each year you can give 16000 to as many individuals as you like and neither you nor the recipient having.

Under current law the estate and gift tax exemption is 117 million per person. Effective January 1 2022 the Federal Estate Tax Exemption is. Property tax exemptions.

The TCJA is set to sunset at the end of 2025. What happens to estate tax exemption in 2026. 18 million estate less 2316 million in two estate tax exemptions 0 taxable estate.

2022 Federal Estate Tax Exemption. Any tax due is. The current estate tax exemption is 12060000 and double that amount for married couples.

Once you die your financial power of attorney is no longer valid. Some properties such as those owned by religious organizations or governments are completely exempt from paying property taxes. A Myth About Estate Planning After I die my financial power of attorney can manage my assets until an Executor is appointed.

Therefore if Congress does not proactively take action to extend the current increased exemptions as of January 1 2026 the. In 2018 the Tax. The adjusted exemption in 2026 is projected to.

Individuals can transfer up to that amount without having to worry about federal. These taxes only apply to that portion of the estate on gift value that exceeds the exemption level. A provision of the Tax Cuts and Jobs Act of 2017 more than doubled the.

31 2025 and will return to the Obama exemption of 5 million adjusted for inflation. The annual gift tax exclusion is 16000 in 2022. You can gift up to the exemption amount during life or at death or some combination thereof tax.

Before The Estate Tax Exclusion Sunsets In 2026 Marotta On Money

Estate Gift Tax A Moving Target But No Clawback Is Certain Karp Law Firm

Impact Of Tax Laws Changes On Estate And Gift Taxes What You Need To Know And How To Act On It Now Credo Cfos Cpas

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

Lock In Lifetime Gift Estate Tax Exemption

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

2020 Estate And Gift Tax Rules And Analysis Part 3 Of 3 Sunset And Clawback In 2026 Youtube

With Gift Taxes And Estate Taxes In Congress Sights Consider Revisiting Your Estate Planning Northwestern Mutual

Planning For 2022 Tax Updates For A Happy New Year The Lynch Law Group Llc Attorneys In Cranberry Twp And Pittsburgh

Estate Tax Current Law 2026 Biden Tax Proposal

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

Estate Tax Current Law 2026 Biden Tax Proposal

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

Favorable Estate And Gift Tax Exemptions May Sunset Sooner Rather Than Later Capaldi Reynolds Pelosi P A

The Jewish Community Foundation Ppt Download

Portability Of Unused Estate And Gift Tax Exclusion Between Spouses

Moaa How The Annual Gift Tax Exclusion Can Be A Powerful Estate Planning Tool